special event

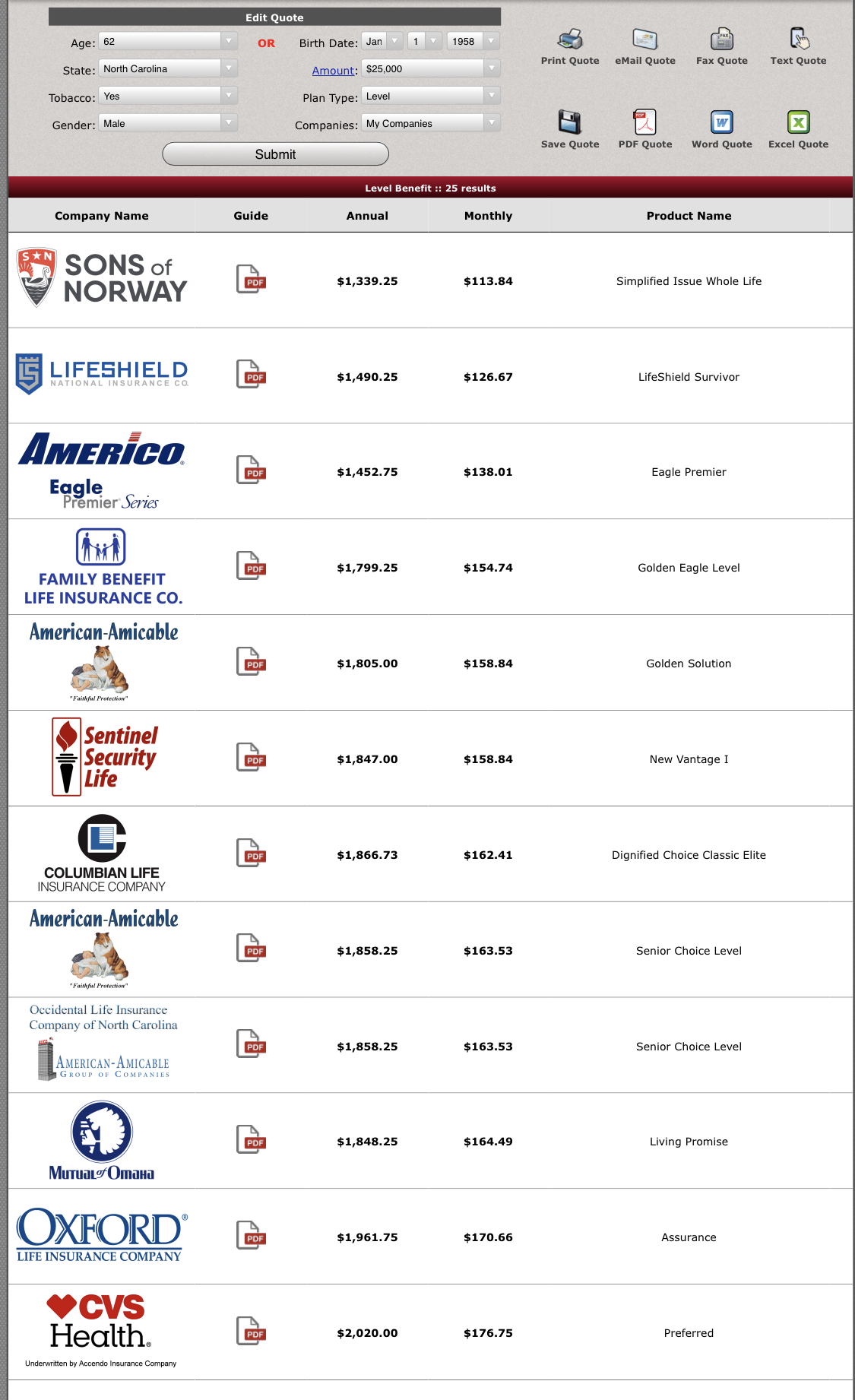

Top 10 FEX

#10

#9

Lowest senior rates

Calculate an 85 year old male $5,000 and Assurant | American Memorial is one of the lowest!

HIGH COMP

HIGH PAYING, DECENT RENEWALS, SMOOTH PROCESS

Phone interview

While you do get an instant decision, a phone interview is needed

Telesales require a phone interview and will decline if replacing a policy

COPD level

If diagnosed over 36 months ago, and no nebulizer, Assurant offers Pref rated for COPD!

#8

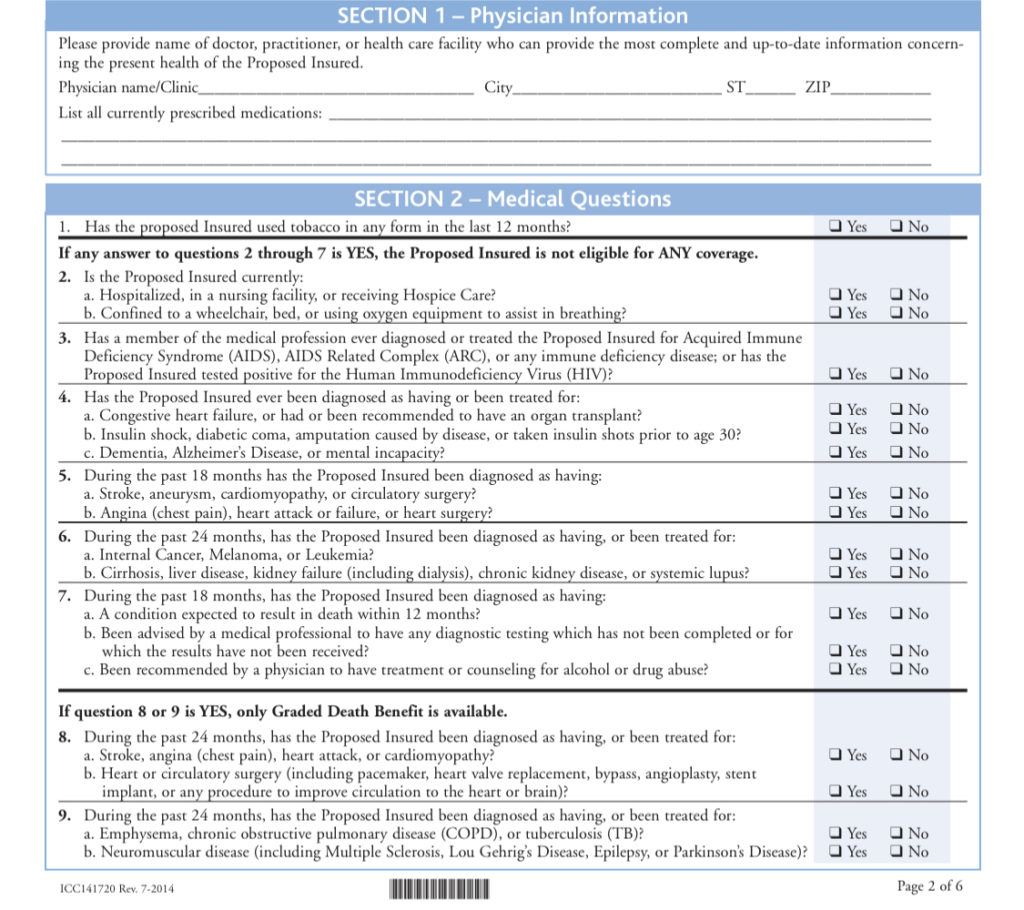

Since 1890, Assurity has served communities across the United States. Many agents write strictly fully underwritten policies, including medical exams, to secure the best price for the client. While Assurity is a fully underwritten, E application, the client is not required to do labs, based on the age chart below

#7

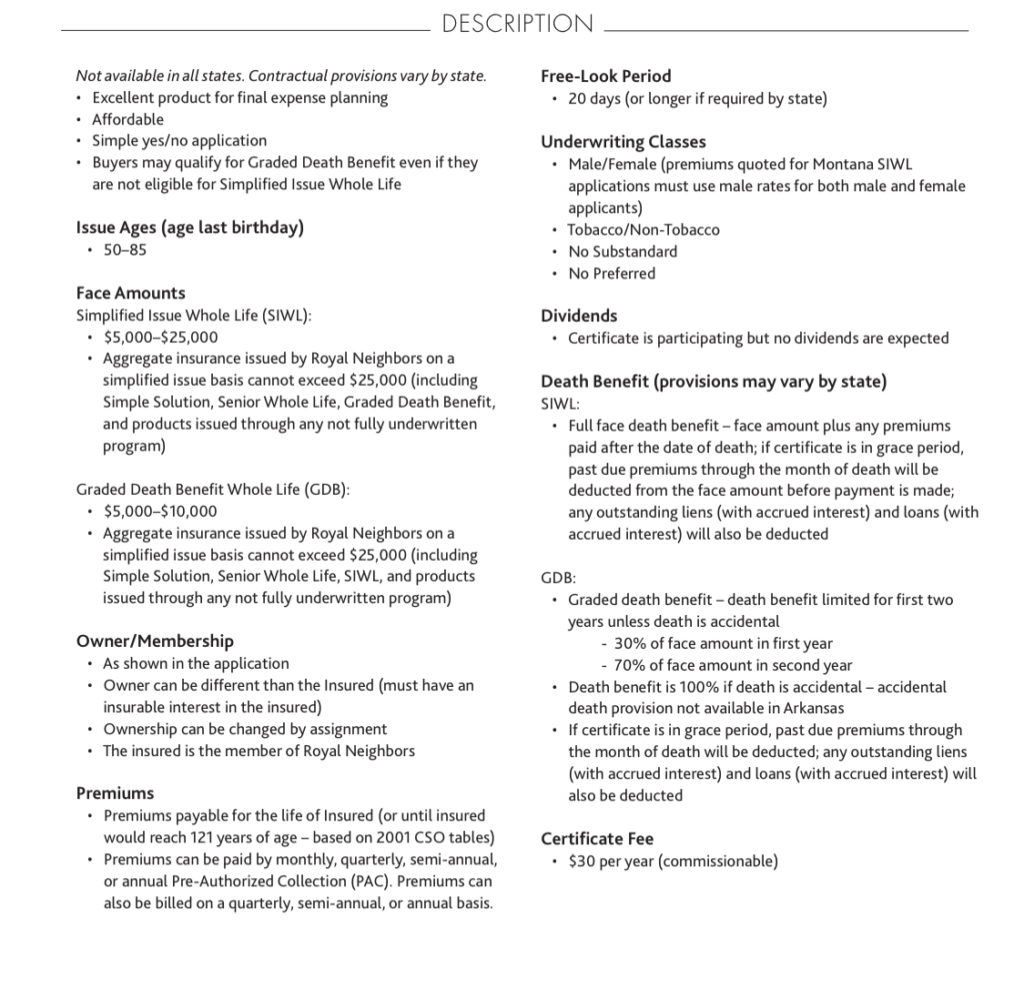

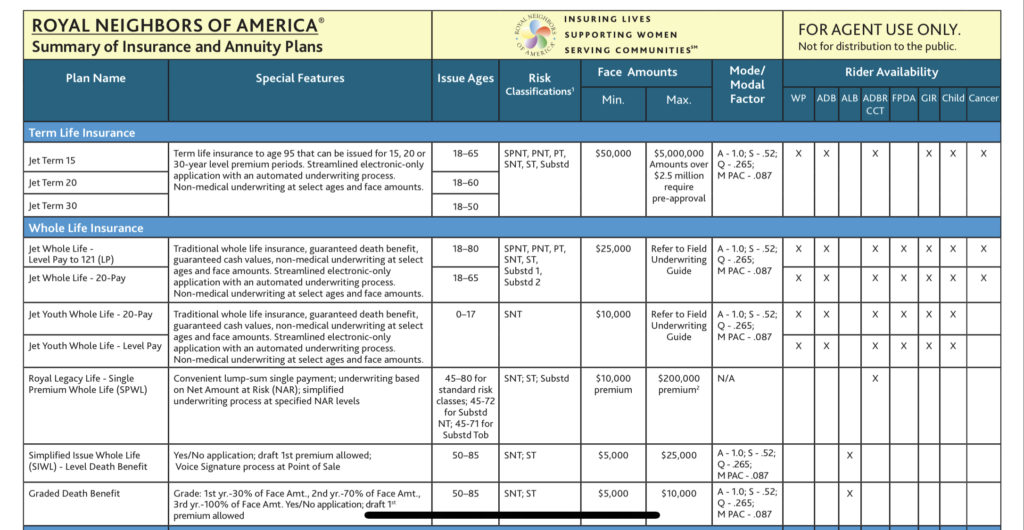

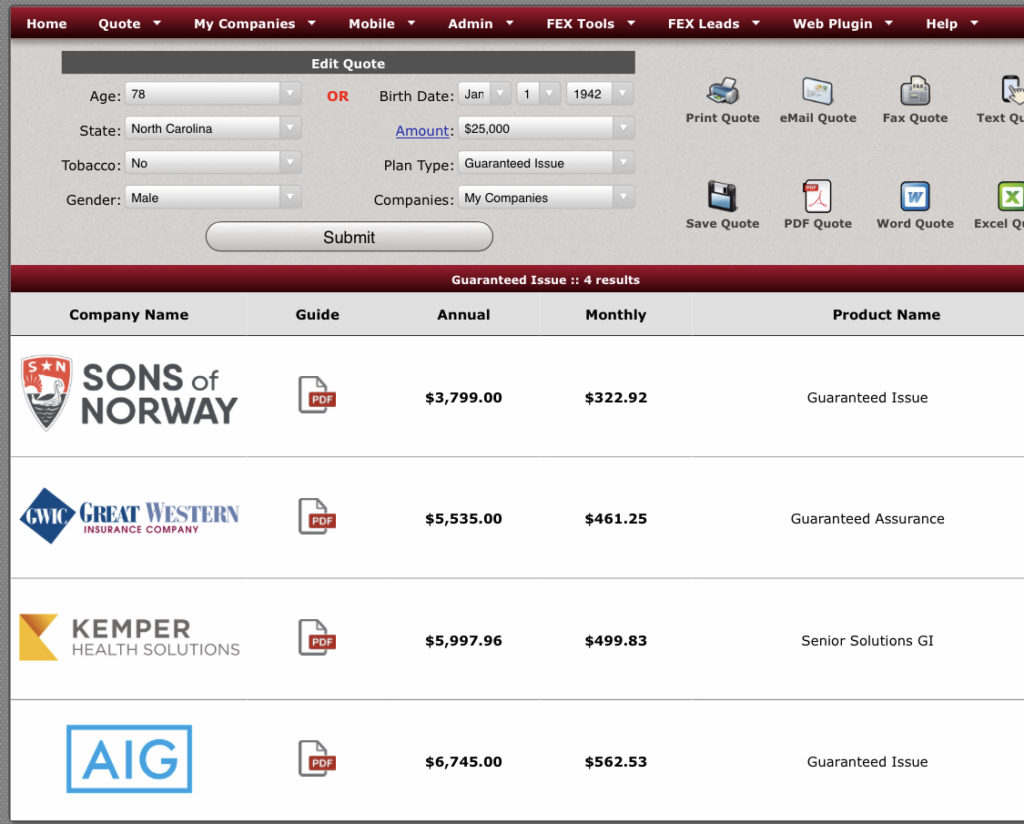

0-85 GI

Sons of Norway is one of the lowest whole life products on the market. Their 0-85 GI or their SIWL. Their only main issues are their drafting system (only drafting the 1st, 8th, 15th, 22nd) and a lower commission. We cannot recommend using SON for all FEX clients, however, some clients will indeed still have their money in the bank on the 8th, if they were paid on the 3rd. Many will not.

#6

Shaping the future

Our exclusive partnership through Transamerica Agency Network & Jay Laycob has a starting bonus like never seen before, laid out below. Jay will work alongside every agent and underwrite their cases, deal with the clients if there’s a problem. Help each person with any issues they need. No more lagging underwriting and endless amendments. Monthly and Bi-monthly Cash bonuses that don’t get returned with chargebacks makes for a nice change of pace. Well done, Transamerica.

Exclusive $9k bonus cash offer

Submit $7,500 and receive 7,500 bonus cash. Net $9,000 in first 3 months for an extra $1,500. No chargebacks on agent rollup.

New & Improved E app

One signature required to complete the entire process. Average completion time of 12-15 minutes. Telesales Capable through the E app.

COPD | Neuropathy

Transamerica may not be the cheapest, or your go to carrier. However, they take the cake for COPD and if Oxford/Prosperity declines neuropathy - Trans is your saving grace.

#5

Trinity is Top Notch, Only in 28 States

Trinity | Family Benefit is slowly expanding into other states. For the states who have access, this is a leading price busting carrier. They do have a lower commission schedule, though approve many conditions such as not asking wheelchair, Diabetic Neuropathy level (insulin started at 40 or later), atrial fibrillation, 2 year look back on cancer, blood thinners Coumadin, warfarin placid, Nitro accepted if no fills within 12 months …etc.

Antiquated Process | Neat Bonus

Agents choose Oxford, LifeShield and Sentinel frequently over Trinity because of the paper application (made digital with Notability, Adobe Fill & Sign) & telephone interview required. They are beautiful when you need them.

They have a 5% lead bonus payable to any vendor after issuing 5k a month.

Credit Cards | Direct Express | Social Security Billing

Aside from commonly topping the charts for the lowest price, Trinity | FB has a solution for most! They do not approve asthma or inhalers.

#4

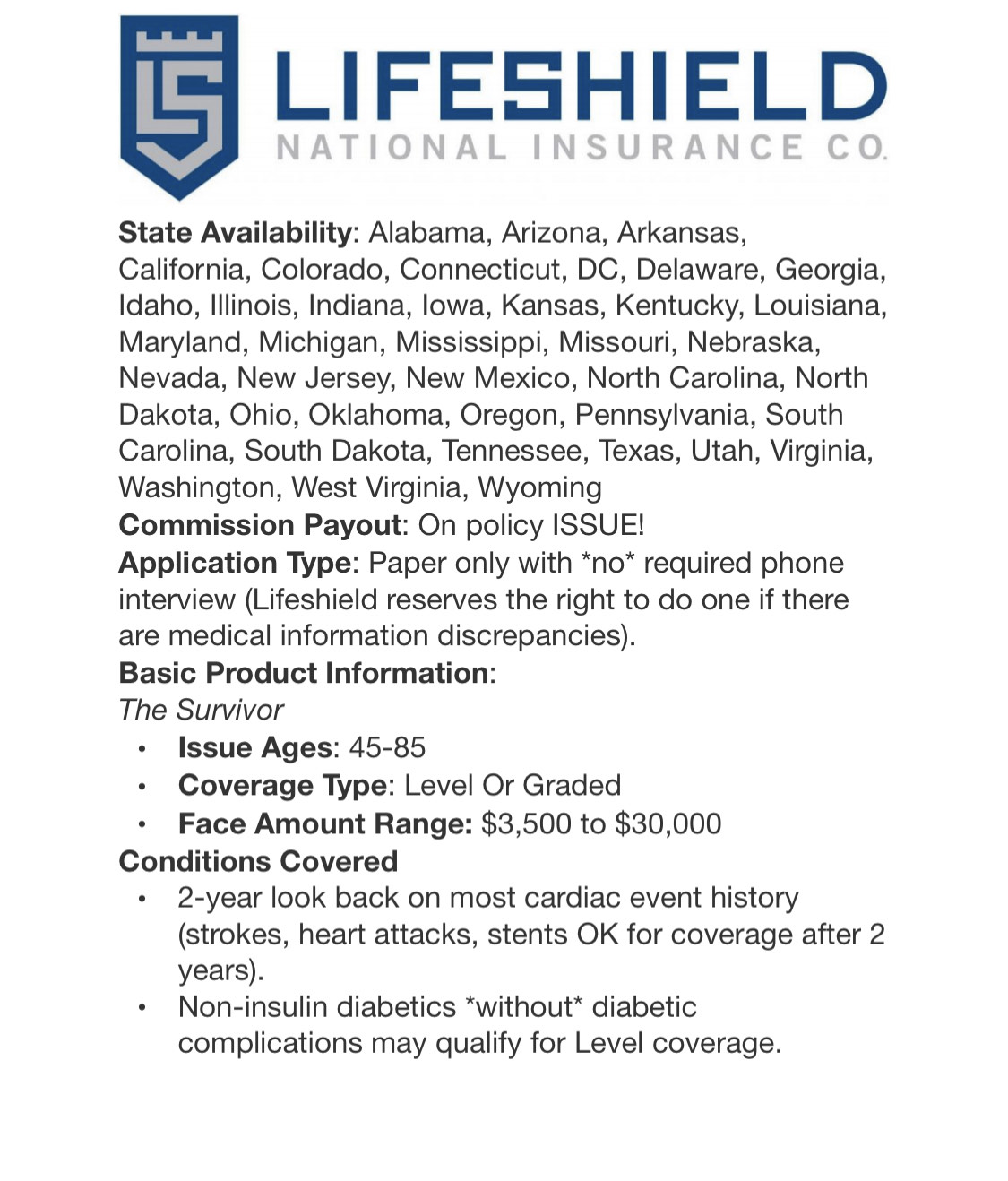

State of the art E app

Fly through the futuristic feel of the intuitive electronic process. Download on iPad only here

https://apps.apple.com/us/app/

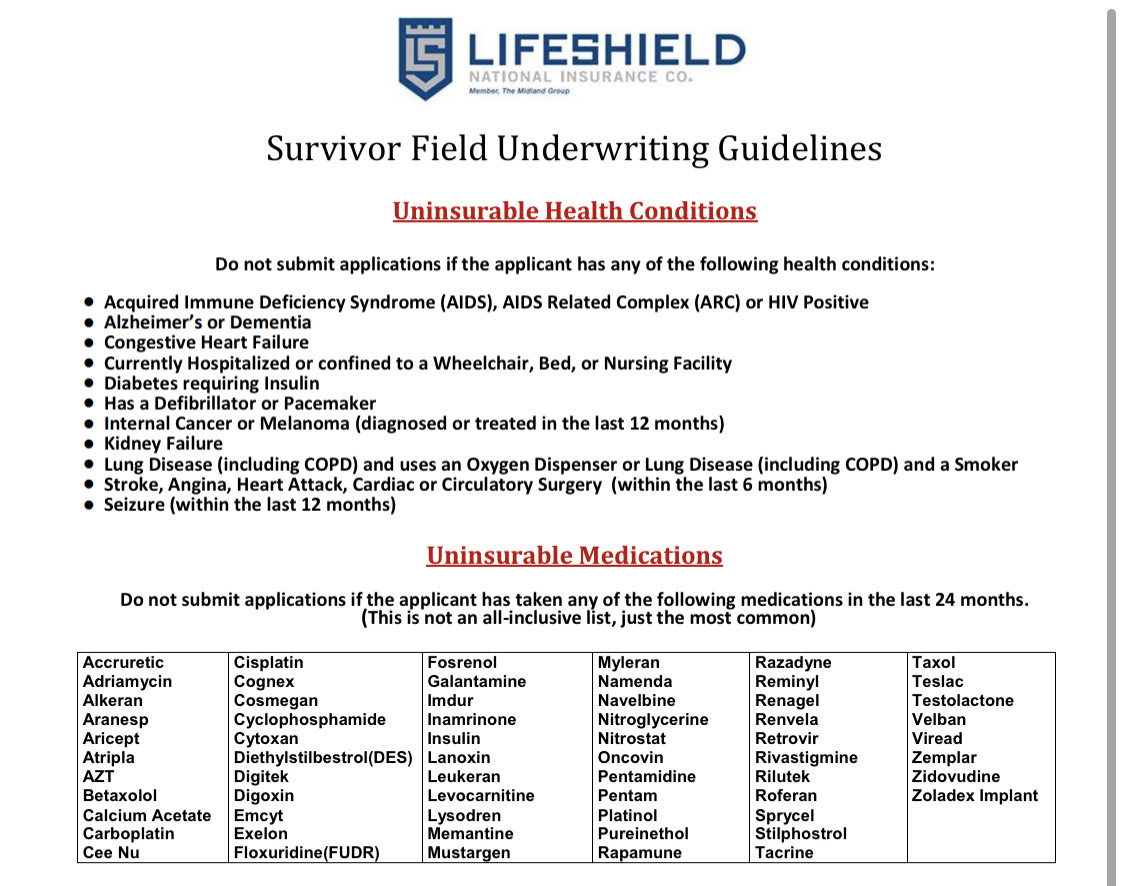

Underwriting

Insulin is a no, so is being 65 or under and on disability. Many conditions other final expense companies approve, LifeShield will too!

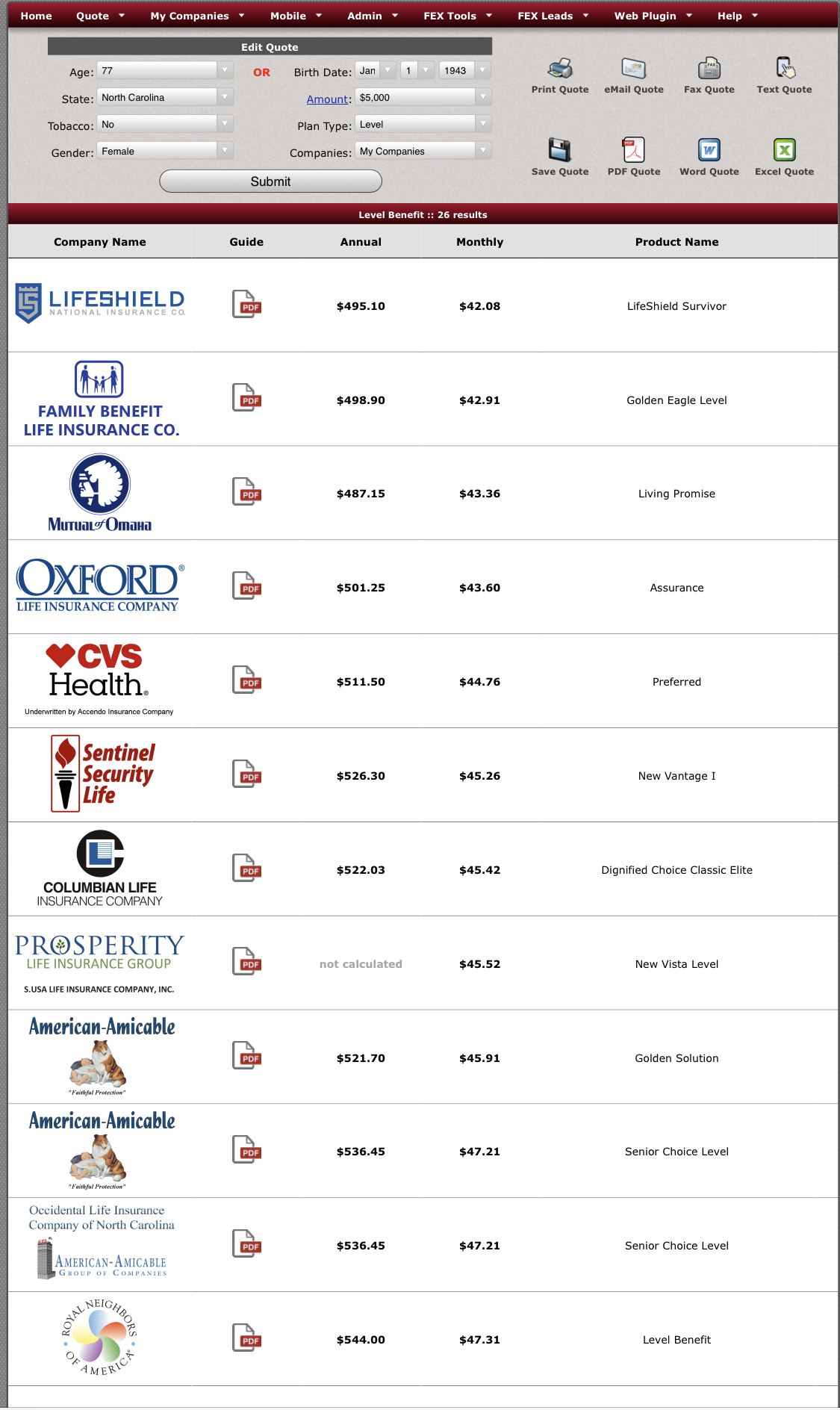

Price Buster

Most will lead with Oxford or Sentinel if all things are even, however, LifeShield sometimes comes in $10 cheaper than our best: $30 lower than MoO.

Top 3

#3

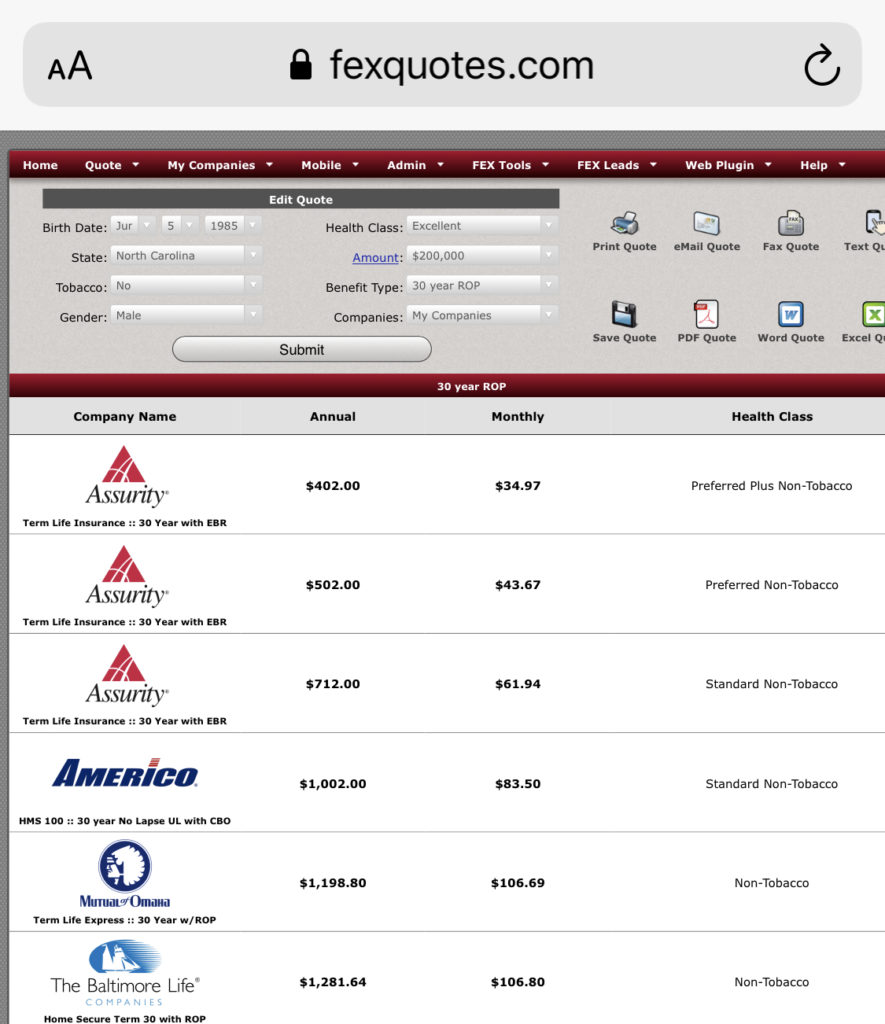

Lowest Priced Death Benefit for Ages 16-65 Healthy

Go to carrier for healthy clients

Sagicor No Lapse Universal Life acts just like a whole life, locking in the price & death benefit up until age 121. On the 6th year, the client is able to reduce the premium and reduce the locked in age to say.. 90!

Since 1840, Sagicor has held a firm grasp on leading the industry in non-med, low cost life insurance. This smooth E app enables healthy prospects age 16-65 to apply for up to $400,000 without a medical exam!

Is shown in the gallery above, whole life is significantly higher than the NLUL! Sagicor also has the best Single Premium product available with their Healthcare ISPUL!

#2

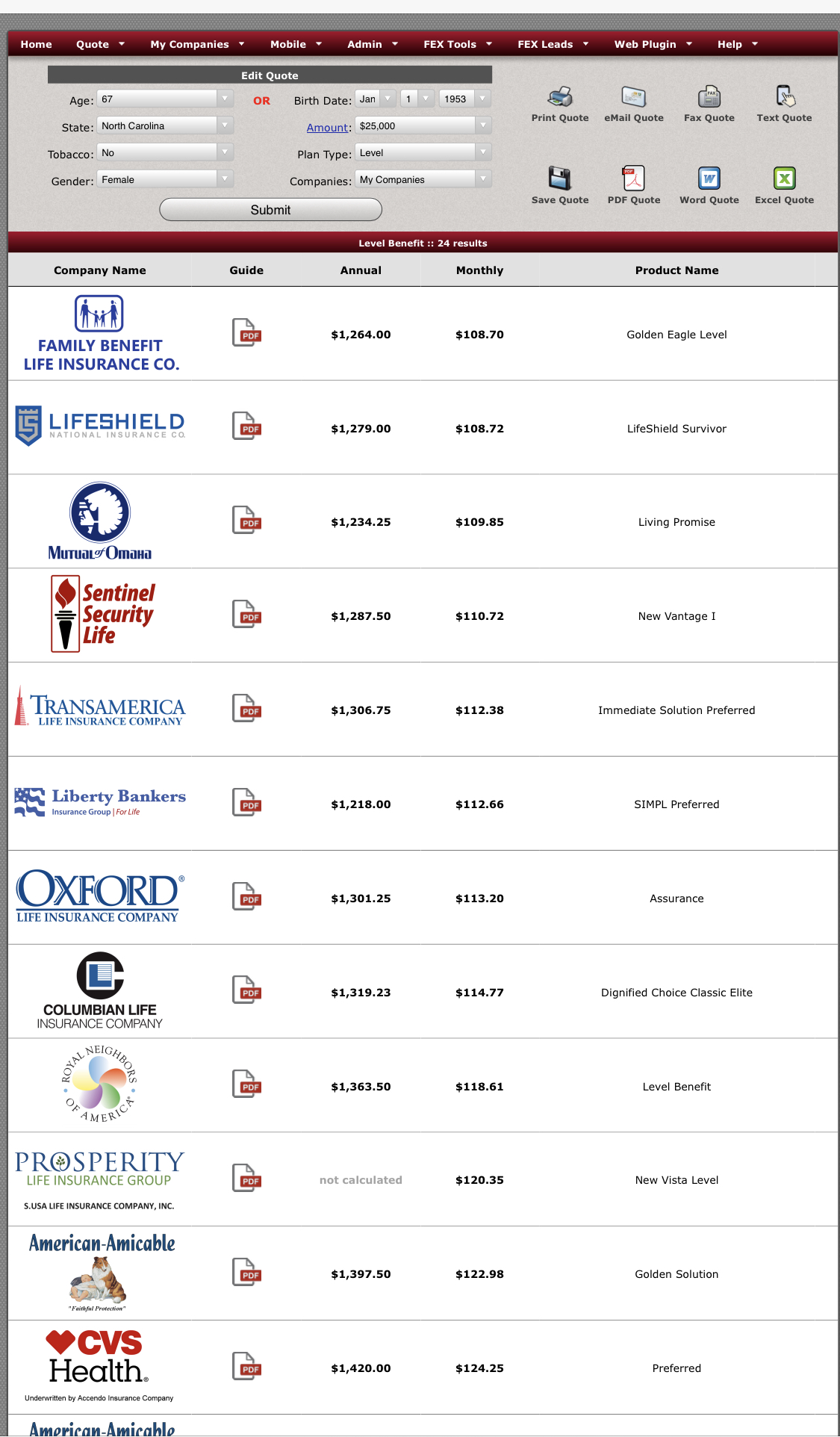

lowest priced

Sentinel is consistently the lowest priced, top paying carrier on the market. Since 1948 they have a great track record of paying claims, replacing expensive carriers & paying some of the highest renewals in the industry

new process

Reluctancy to write Sentinel is no more, as the lengthy phone interview is rendered obselete. Now the E app is signed by a 3 minute voice signature through an automated system. Sentinel is TELESALES capable!

30/70/100 Graded

Oxygen is covered under 30/70/100 (day one coverage), only cuts commissions by 20% & still advances! They do have a 5 year look back on the heart (pivot to Oxford)

$500 Bonus

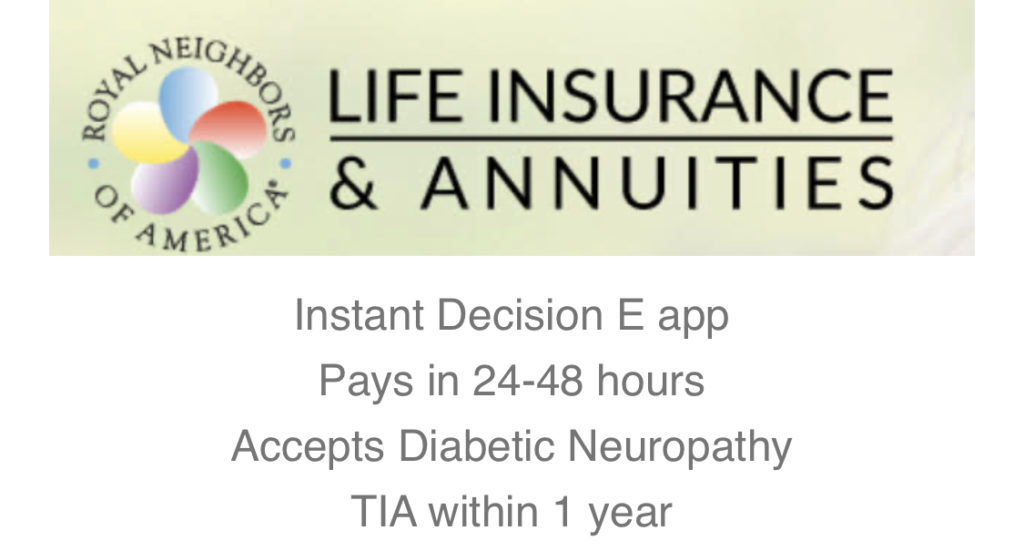

Sentinel Security Life & Royal Neighbors of America production counts toward our monthly bonus of $200-$500!

Disclaimer

The all around best life product for a healthy individual ages 16-65 is Sagicor NLUL. If not healthy enough & looking to secure the lowest rate, LifeShield, Family Benefit, Sons of Norway, are typically lowest price. Source: FEXquotes.com. Considering the small difference of price between Oxford, Sentinel, Trinity & LifeShield on the majority of situations & the stark difference in commission paid – The two best final expense carriers are awarded to Oxford Life & Sentinel Security Life and could be considered tied for 1st Place!

#1

Best overall e app

A one page, blog style E app eliminates long loading times. Instant Decision and lowest rates!

Increase Your Odds

$10,000 never appeared so affordable to a prospect, and because of this, you’ll make more sales.

Sell the lowest products in the industry. Churning occurs when there is not a blatant increase of benefit for the client. Careful churners, you could easily lose your license.